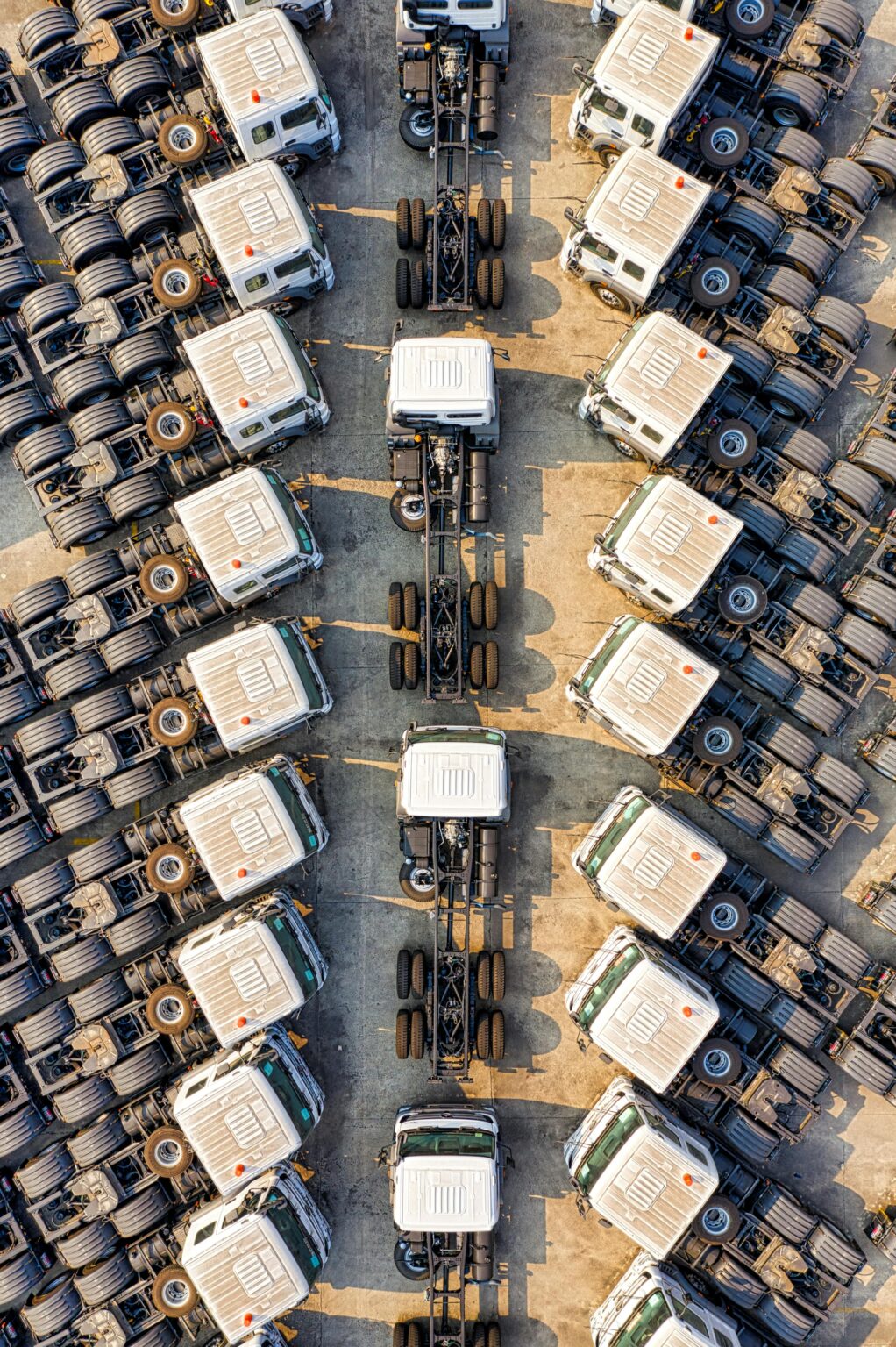

Trucking & Hauling

Our dedication to empowering vital industries drives us to offer tailored funding solutions for trucking businesses across the US.

We know what it takes to run a trucking business

Discover the perfect financing structure for your logistics business’s next big move with Approvd. Our flexible funding solutions are designed to meet the unique needs of logistics companies, helping you stay on track and achieve your goals.

Use funds to bridge capital between account receivables gaps, ensuring smooth cash flow and uninterrupted operations. You can also purchase essential supplies and materials, cover unexpected truck repairs, and ensure your employees are paid on time.

Whether you’re looking to transition to an owner-operator model or expand your services, Approvd provides the financial support to help you grow and thrive.

With Approvd, the process is quick and simple, allowing you to focus on running your logistics business while we take care of your financing needs. Our extensive network of lenders offers competitive rates and terms, ensuring you get the right funding solution tailored specifically to your business.

- Types of business funding for trucking businesses.

Revenue-based financing is ideal for trucking companies with fluctuating income. You receive capital in exchange for a percentage of future revenue, making repayments manageable during lean periods. This flexibility allows you to invest in growth opportunities without rigid repayment schedules.

Debt financing provides a lump sum of capital for significant investments, such as purchasing new trucks or upgrading equipment. With fixed repayment terms, you can manage your budget effectively and scale your business while preserving cash reserves for daily expenses.

A line of credit gives trucking businesses flexible access to funds as needed, allowing you to cover unexpected expenses like urgent repairs without disrupting cash flow. You can borrow only what you need and pay it back, keeping your operations smooth and efficient.

Four simple steps to trucking funding

1. Tell us about your business.

Answer a few simple questions and complete the application in minutes.

2. Submit your application.

We’ll present your application to our marketplace 75+ lenders. Applying is free and won’t impact your credit score.

3. Compare offers.

Find the funding option with the terms that best fit your small business goals.

4. Get funded.

Get Your Funding Approved within 24hrs

Get funded in just 72hrs.

- Why use a retail business funds?

Improved Cash Flow Management

Business funding can significantly enhance cash flow management for trucking companies. By providing access to capital, businesses can cover operational costs like fuel, maintenance, and payroll without delay. This ensures that daily operations run smoothly and that there are no interruptions in service due to financial constraints.

Fleet Expansion and Upgrades

With adequate funding, trucking companies can invest in fleet expansion and upgrades. This allows businesses to purchase new vehicles, modernize existing ones, and incorporate advanced technologies that improve efficiency and safety. A well-maintained and updated fleet can lead to increased capacity, reduced downtime, and better service for clients.

Adaptation to Market Changes

Access to business funding enables trucking companies to adapt to changing market conditions. Whether it's taking advantage of new contracts, responding to increased demand, or navigating economic challenges, having financial resources available allows companies to pivot quickly. This adaptability can help secure a competitive edge in the industry.

Way to use a trucking business funding

In the fast-paced trucking industry, reliable and efficient trucks are essential. A business fund can help you buy new or used trucks, make repairs, or upgrade your fleet.

Fuel and maintenance costs add up quickly while you’re waiting for customers to pay on net 30, 60, or 90-day terms. A fund can provide the funds you need to continue to take on more business and grow your revenue.

Growth is an ongoing goal for any successful business. A trucking business fund could provide the capital to purchase additional trucks so you can open new routes or even start a new branch of your business.

Ready to make the leap from company driver or lease operator to owner-operator? A business fund can help you cover the costs necessary to strike out on your own.

We are here to address any questions you may have as you implement your plan. Additionally, for clients seeking an ongoing partnership, we provide comprehensive Wealth Management Services.