Unlock your financial potential with

expert guidance

strategic insights

personalized advice

cutting-edge technology

comprehensive planning

Comprehensive financial consulting services tailored to your needs

See if your business is eligible for

Line of Credit

Business Term loan

Revenue-Based Financing

Hard Money Loan

✓ One application

✓ 75+ lenders

✓ Multiple offers

As Seen In

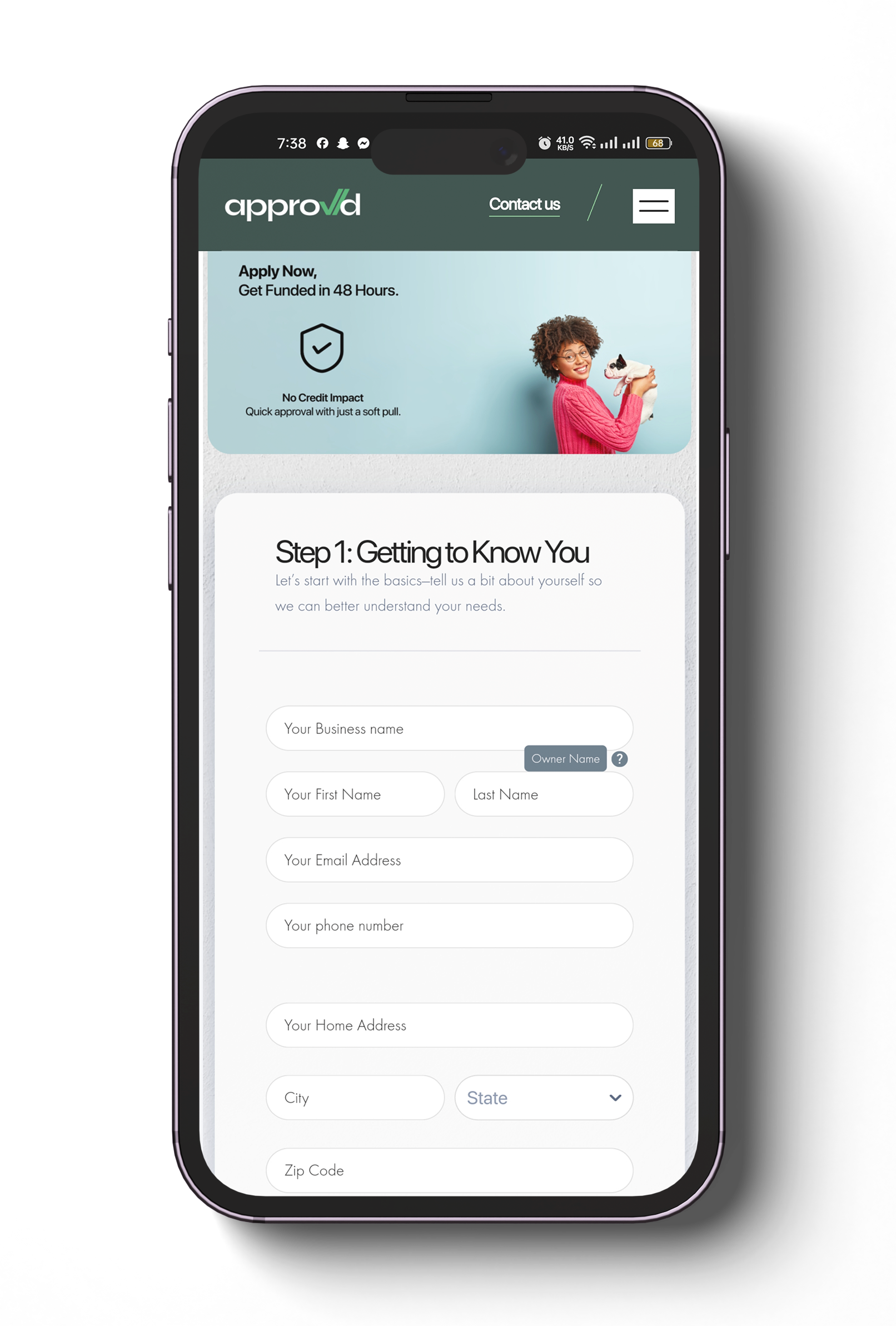

Four easy steps to secure funding:

Tell us about your business:

Provide basic information and complete the application in just a few minutes.

Submit your application:

We’ll connect you with over 75 lenders. It’s free to apply, and your credit score won’t be affected.

Compare offers:

Choose the funding option that aligns with your business needs and goals.

Receive funds:

Once approved, you can have funds in your bank account within 24 hours

Why us

Trusted experts with years of experience and industry accreditations

We’re redefining the future for small business owners, providing them with funding that fuels their ambition, empowering them to grow beyond just being entrepreneurs.

A decade of proven financial expertise.

Helping businesses grow with the funds they need.

A dedicated team of underwriters and lenders who help us give best deals

Revenue-Based Financing

Funding Amount

Starting from $5,000 to $1 million in working capital

Factor Rates

Factor rates as low as 1.12 and prepayment initiatives.

Flexible Options

Borrow more funds after paying at least 50% of the original financing.

Business Line of Credit

Funding Amount

Get Lines of credit from $10,000 to $250,000.

Repayment Terms

With Super flexible repayment tern starting 6, 12, 18 or 24-month terms.

Flexible Options

You can get additional funding options alongside your business credit line.

Business Term Loan

Funding Amount

Get a business term Loans from $10,000 to $5 Million.

Repayment Terms

Flexible Terms options starting from 6 to 60 months terms.

Factor Rates

With very attractive Rates starting at 8% APR.

How much could you qualify for? Find out now.

Applying is free and won’t impact your credit.

✓ One Application

✓ 75+ Lenders

✓ Multiple Offers

Industries We Help Grow!

Rooted in integrity, trust, and a focus on our clients, our values guide every action we take.

Integrity

Uphold high ethical standards and act with honesty, transparency, and professionalism in all your interactions.

Trust and Confidentiality

Understand the importance of trust and confidentiality in your client relationships.

Objectivity

Provide unbiased advice that is based on thorough analysis, research, and a comprehensive understanding of your clients' financial situations.

Expertise

Stay up-to-date with industry trends, regulations, and best practices to offer informed advice to your clients.

Long-Term Relationships

Build long-term relationships with your clients based on trust, open communication, and mutual respect.

Accountability

Monitor progress, review strategies, and make adjustments as needed to help clients stay on track towards their financial goals.

Testimonials

Those who trust us

Working with Approvd has been a game-changer for my financial future. Their expertise and personalized guidance have helped me achieve my goals with confidence.

I’ve been a client for years, and they always go above and beyond. Their professionalism, integrity, and commitment to my financial success are second to none.

The financial guidance and support I’ve received have been truly invaluable. They possess a deep understanding of my needs and have made navigating complex financial decisions much easier for me.

Get started &

Schedule your call with us today

We

are

better

together.

Drop your contact details into the form, and we’ll reach out to you!