Healthcare

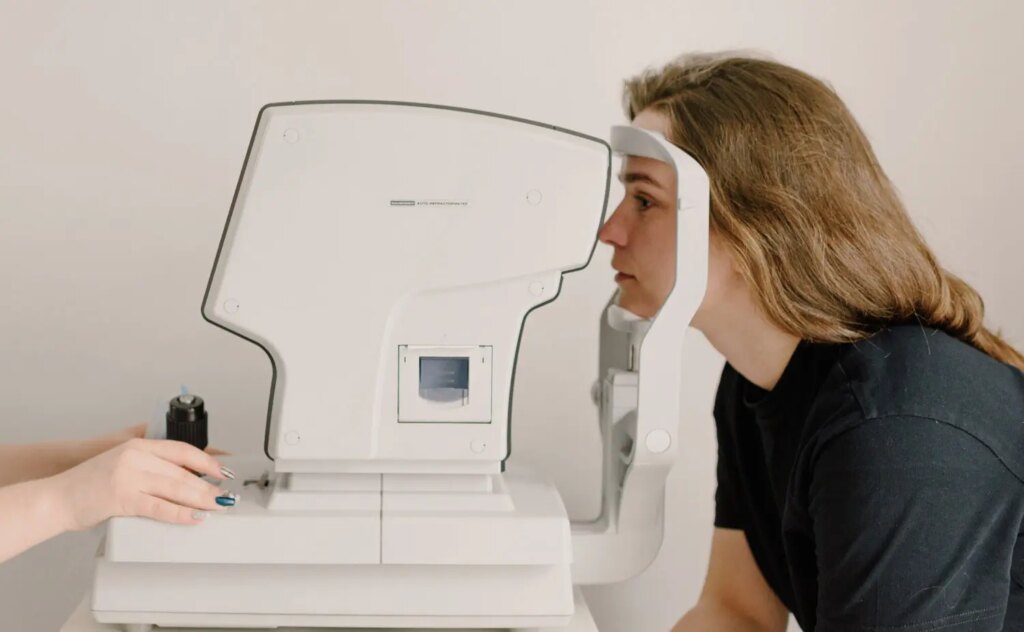

Supporting the healthcare and wellbeing industry to thrive to its maximum potential, We fund dentists, clinics, hospitals, and others.

- Sector expertise

Pharmaceuticals

Pharmaceutical and biotech companies must perform at a high level across all areas of their operations, from research and development to supply chain management and commercialization. Achieving flawless execution in these domains is vital for success in the industry.

Medical Technology

The MedTech landscape is quickly transforming, marked by the rise of innovative devices, integrated platforms, and digitally driven sales and service models. At Approvd, we specialize in guiding clients through these changes, helping them craft effective strategies and execute them with precision.

Healthcare Payers

We can help you increase market share in stagnant areas, expand into profitable new markets, optimize the Medical Loss Ratio, leverage data analytics, enhance member experiences, and streamline automation processes.

Healthcare Providers

To attain and sustain a competitive edge, a well-designed strategy, customized operating model, and effective change management are crucial. We can help you tackle these challenges by providing strategic guidance and expertise in creating and implementing the right operating model, empowering your organization to succeed in the evolving healthcare industry.

How we help

Approvd boasts a strong track record of providing exceptional case work and collaborating effectively with leaders and investors within the healthcare ecosystem. Our expertise promotes innovation and adds value for our clients in the healthcare industry.

1200+

2,700+

Client results

Discover how we’ve empowered businesses like yours to overcome challenges and achieve significant outcomes. Explore our case studies to learn more.

- Small Business Solutions

Revenue-driven funding vehicle that offers businesses quick access to funds by borrowing against their future receivables.

Credit lines provide flexible, revolving access to a predetermined limit that replenishes as it’s repaid, allowing entrepreneurs to access capital on their terms.

A term loan provides a lump sum of capital that is repaid over a fixed term with regular payments, making them ideal for larger investments and/or purchases.

Combine multiple loans into a single, new loan designed to free up cash flow and simplify the repayment process.

Hard money loans are short-term loans secured by real estate, typically used by investors or developers to quickly acquire funds for property purchases, renovations, and fix-and-flips.